Nexro Fund:

Intelligent Market Evaluation Powered by Nexro Fund

Sign up now

Sign up now

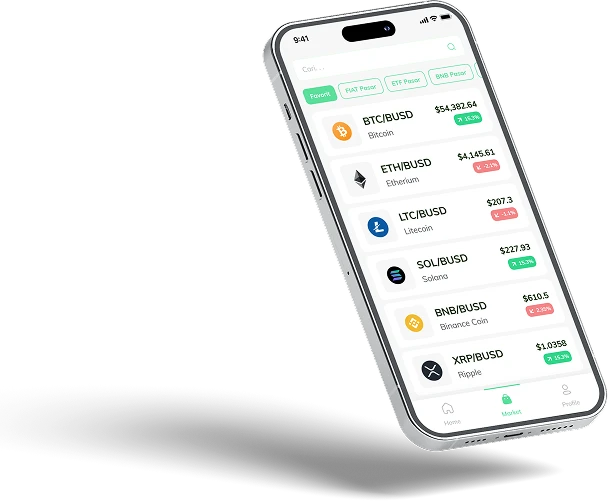

Nexro Fund applies artificial intelligence and machine learning to continuously observe crypto market behavior as it unfolds. Instead of reacting to isolated price changes, the platform evaluates liquidity behavior volume interaction and evolving participation patterns to surface relevant market signals from live data streams.

To maintain analytical focus Nexro Fund delivers alerts only when predefined market conditions are met. This selective approach reduces noise and highlights meaningful developments presenting market information in an organized format that supports clearer assessment and informed decision making.

When trend direction shifts or market structure changes become evident Nexro Fund arranges these signals within layered analytical models. This structure supports calm evaluation during rapid market movement while reinforcing strong security standards and usability. Cryptocurrency markets are highly volatile and losses may occur.

Instead of depending on lagging indicators Nexro Fund evaluates live price behavior at the moment structural shifts begin to emerge. Momentum rotation controlled pullbacks and active order flow are assessed through AI driven models to build organized market context. Machine learning continuously filters outdated data so insight remains centered on current forces shaping movement. Secure delivery and a user friendly interface provide real time AI powered market insights with optional copy trading support for ongoing observation.

Rather than reacting to temporary instability Nexro Fund analyzes early volatility patterns to isolate meaningful behavioral change. Pressure variation directional imbalance and pace adjustment are interpreted using AI driven systems to convert disorder into structured understanding. Machine learning refinement maintains relevance while constant monitoring supports alignment with present market conditions. Cryptocurrency markets are highly volatile and losses may occur.

As live conditions evolve Nexro Fund recalibrates its analytical structure by monitoring participation response execution behavior and layered confirmation logic. Extensive data inputs are transformed into clear market insight without reliance on delayed confirmation tools. Only validated analytical outcomes are displayed to reflect authentic real time market structure.

Nexro Fund utilizes disciplined analytical frameworks engineered to function consistently across changing market environments and diverse trading styles. Insight generation remains fully independent from trade execution to keep attention centered on analytical understanding rather than transactional behavior. Layered logic validated data processing continuous performance review and contextual risk awareness operate together to support careful interpretation and cryptocurrency markets are highly volatile and losses may occur.

Nexro Fund functions within a security driven analytical environment where layered encryption controlled access and verification protocols protect all internal processes. As no trade execution is performed the system does not interact with user funds or private financial credentials. Ongoing validation and monitoring preserve system stability while limiting unnecessary data exposure.

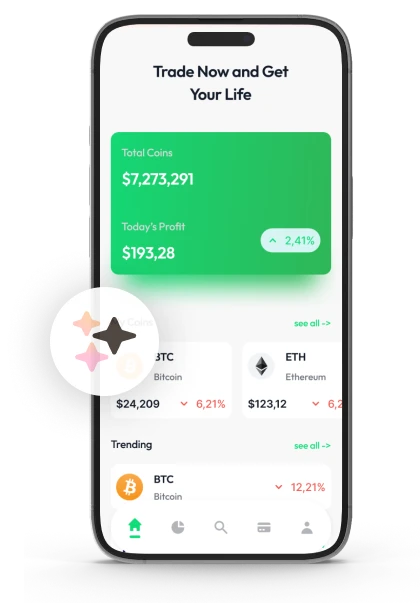

Nexro Fund presents market behavior through a structured visual framework that emphasizes key zones directional progression and behavioral transition. All visual representations are generated through AI driven computation rather than subjective judgment. This approach encourages objective comparison organized observation and consistent evaluation while helping reduce emotional influence during analysis. Cryptocurrency markets are highly volatile and losses may occur.

Rather than depending on historical pattern repetition Nexro Fund observes live price interaction as momentum begins to emerge. Developing movement is captured at its initial stage with precise timing alignment. Analytical focus remains centered on active participation instead of delayed effects from prior market phases.

Volatile price behavior is reorganized into defined analytical layers that highlight genuine structural progression. Insight remains synchronized with live conditions, allowing directional changes to surface naturally as they form. Each analytical result is refined to limit delay impact and suppress interpretive distortion.

Nexro Fund recalibrates analytical alignment in real time as market conditions shift. Changes in participation strength, liquidity movement, and expansion phases are tracked continuously without dependence on fixed reference models. Insight reflects active engagement rather than historical assumptions.

Instead of distributing unprocessed signals, Nexro Fund applies confirmation logic to incoming data. Noise and non structural fluctuations are filtered out, isolating authentic directional behavior. Cryptocurrency markets are highly volatile and losses may occur.

When internal balance begins to change, Nexro Fund captures pressure accumulation, volume redistribution, and directional realignment as they emerge. Persistent monitoring ensures analytical relevance remains aligned with current conditions.

Nexro Fund delivers a streamlined interface with prioritized visuals, responsive controls, and organized layouts. Adjustments and insight access occur smoothly, preserving uninterrupted analytical concentration.

Nexro Fund transforms live market interaction into structured analytical intelligence by evaluating participation behavior, timing alignment, and directional cohesion. Rather than focusing on finalized results, emerging structure is observed as it forms in real time.

Incoming data streams are organized into layered momentum models that support clarity during rapid acceleration or irregular movement. This approach maintains contextual awareness and steady interpretation as market conditions continuously shift.

To ensure dependable analysis, Nexro Fund operates within reinforced computational systems guided by adaptive logic processes. Insight remains synchronized with active behavior, preserving consistency, balance, and analytical reliability while supporting disciplined decision frameworks and long term interpretive stability.

Nexro Fund uncovers early momentum formation through a layered confirmation process that combines directional strength agreement, expansion validation, activity zone assessment, and depth sensitive evaluation. Signals are released only when multiple conditions align, ensuring clarity without analytical ambiguity.

Market direction is examined through a progressive reasoning structure that measures velocity change, directional continuity, and repeated activation as a unified system. Once dominant pressure aligns, insignificant noise is removed, leaving only confirmed structural evidence.

Nexro Fund recognizes developing phase shifts before movement becomes visually evident. Subtle rhythm changes, pressure redistribution, and balance variation are identified immediately, keeping analysis synchronized with real time behavior rather than lagging confirmation tools.

Analytical responsiveness within Nexro Fund adjusts dynamically to match varying evaluation speeds. Short horizon analysis benefits from rapid responsiveness, while extended horizon assessment receives stability focused insight designed for broader structural review.

Through structured flow mapping, Nexro Fund identifies where momentum initiates, where compression develops, and where directional rotation may emerge. Each phase is proportionally weighted to support disciplined interpretation and structured planning.

Nexro Fund evaluates multiple potential market paths simultaneously by aligning projected behavior with predefined analytical models. Trend endurance, reaction development, and pressure concentration are assessed to strengthen insight consistency over time. Cryptocurrency markets are highly volatile and losses may occur.

Nexro Fund transforms live price movement into clearly defined interaction regions using spatial logic and momentum based evaluation. Instead of saturating charts with excess signals, attention is directed only to areas where continuation or reversal probability increases. When multiple analytical factors converge, zone relevance is elevated for priority review.

Visual structure illustrates how price energy evolves over time. Compression behavior, rotational movement, and structural exhaustion are evaluated together to determine whether conviction is strengthening or weakening. As alignment improves, zone significance becomes clearer, reducing speculative interpretation.

To maintain analytical discipline, Nexro Fund displays only indicators with sustained reliability. Visual elements adapt alongside real time rhythm changes, while internal prioritization logic continuously reassesses zone importance. Market evaluation remains structured and consistent rather than reactive.

Rapid crowd response, narrative change, and emotional reaction often disrupt timing accuracy. Nexro Fund minimizes this effect by measuring engagement intensity, sentiment velocity, and reaction speed across multiple behavioral dimensions. Emotional momentum is evaluated independently before being aligned with price structure to reduce misinterpretation.

Sentiment behavior is monitored across both short and extended intervals, allowing early identification of abrupt emotional reversals. Intensity and rate of change are analyzed together to reveal weakening conviction beneath visible price movement.

By synchronizing behavioral sentiment with structural pressure, Nexro Fund delivers balanced analytical perspective. When emotional response diverges from price structure, alerts prompt immediate reassessment to support disciplined evaluation. Cryptocurrency markets are highly volatile and losses may occur.

Digital asset markets frequently react to shifts in global economic conditions. Changes in inflation expectations, employment data, and growth outlook can redirect capital flow. Nexro Fund tracks these developments through an integrated macro intelligence layer, evaluating scale, timing, and relevance before translating them into structured market context.

Advanced analytical models link macro behavior with live crypto price structure. By comparing historical macro inflection points with current conditions, Nexro Fund highlights moments when external data reinforces emerging price behavior. Insights are ranked by projected impact to minimize low relevance noise.

Nexro Fund integrates automated data analysis with structured rule based evaluation to deliver precise market awareness. It continuously tracks directional flows, liquidity concentrations, and fragmented activity, drawing attention to atypical developments as they arise.

Analytical focus adapts dynamically, prioritizing the most relevant live data. Price movements are assessed within complete market context rather than in isolation, ensuring insights reflect true market behavior. The interface remains intuitive, streamlined, and fully user directed.

Minor imbalances often signal upcoming directional changes. Nexro Fund links subtle variations in pacing with historical volatility patterns to generate early alerts, supporting structured planning instead of reactive moves.

Sudden accelerations can appear without warning. Nexro Fund identifies these events as they unfold, mapping emerging reaction areas and providing concise situational context. Alerts specify origin, intensity, and short term significance while leaving execution to the user.

Through ongoing structural analysis, Nexro Fund detects early trend formation and highlights actionable setups before widespread participation occurs. Pressure accumulation, directional flow, and key inflection points are identified to aid anticipation.

Unexpected fluctuations can disrupt planning, yet Nexro Fund maintains consistency through continuous structured feedback. Alerts are triggered only when patterns confirm stability, allowing measured and controlled decision making.

Nexro Fund employs flexible analytical layers and validation protocols to uncover hidden price behavior, evaluate order flow pressure, and identify reliable reaction zones. Continuous monitoring of sentiment, participation, volume, and momentum enhances directional awareness while all trading actions remain manual.

The analytical system recalibrates instantly to retain clarity during sharp expansions or sudden market shifts. In fast moving crypto markets, structured logic encourages risk awareness and disciplined evaluation.

Nexro Fund converts high speed market data into organized analytical insights through AI powered visualization, structured evaluation frameworks, and planning models. Insight delivery is fully independent of trading accounts, ensuring market interpretation remains objective without influencing execution decisions.

Nexro Fund is built for intuitive use from the first interaction. Beginners follow a guided setup flow that emphasizes clarity, with a streamlined interface and easy to use tools. Over time, more advanced features like comparative metrics and deeper analytical functions are gradually introduced for enhanced exploration.

No. Nexro Fund does not execute or manage trades for users. It provides organized market analysis, identifies potential opportunities, and offers timing guidance, while all trading decisions and actions are performed manually by the user.

| 🤖 Enrollment Cost | Free of charge enrollment |

| 💰 Transaction Fees | No transaction fees |

| 📋 SignUp Procedure | Efficient and prompt registration |

| 📊 Curriculum Focus | Courses on Cryptocurrencies, the Forex Market, and Other Investment Vehicles |

| 🌎 Accessible Regions | Excludes USA, available in most other regions |